If you are like most people, you are likely dependent on your vehicle for work, school, childcare, getting groceries, and everything else involved in your day-to-day life.

Getting involved in an auto crash comes with some terrible consequences. One of the bad downsides is getting totaled by the insurance company. It’s usually annoying if your car is totaled despite having what might seem to be a minor accident. In this situation, you may wonder if you can still keep your totaled car.

When you purchase a new car, one of the first things you must consider is auto insurance. It’s crucial to have coverage in case of accidents or unexpected events. If you ever need to file a claim, your insurance company will guide you through the process of submitting an insurance claim. It’s important to provide accurate information when you file a claim to ensure a smooth and timely resolution.

This article will consider some questions and concerns raised by most persons whose vehicles have been totaled.

Car Accident: What does it mean when my car is totaled?

A car usually gets totaled by the insurance company if the cost of repairing the car exceeds the current value of the vehicle, the car is totaled or deemed a “total loss.”

Suppose you have a 5-year-old car with a current market value of $15,000. You get into an accident, and the repair shop estimates the cost of fixing the vehicle to be $18,000.

In this scenario, your car insurance company would likely total the car since the repair cost is higher than the car’s value.

This means they would pay you $15,000 (or the actual cash value stated in your policy), and take possession of the totaled car. They may then sell the car for parts or scrap metal.

Here are some additional points to consider:

- Some insurance policies may allow exceptions to the totaling rule. For instance, if your car is a classic or has sentimental value, your insurance company might be willing to pay more than its market value to repair it.

- The threshold for totaling a car can vary depending on your insurance company and state laws. Just get acquainted with the state laws.

DID YOU KNOW?

According to a study by the National Insurance Crime Bureau, the total number of cars in the US has steadily increased over the past decade. This is due to several factors, including rising car repair costs, the increasing complexity of modern vehicles, and more distracted drivers on the road.

What if choose to keep a totaled car that is still drivable?

You may be able to retain ownership of your totaled car, but it comes with a cost. Insurers sell totaled cars through auctions to car dealers or scrap yards for parts. So extra effort is required for you to keep your vehicle.

If you keep your totaled car, the insurer will subtract the salvage value from your insurance payout. Below is an example

For instance, if your car’s actual cash value (ACV) is $5,000 and the salvage value (SV) is assessed at $500, your insurance settlement would be $4,500 ($5,000 – $500).

Repairing totaled cars can be financially burdensome. Obtaining a salvage title for a totaled car is mandatory in most states.

However, cars with salvage titles are challenging to sell and insure. It’s crucial to weigh the expenses and potential complications before keeping a totaled car.

Contrary to what the term “totaled” might imply, not all totaled cars are destroyed or inoperable. Insurance companies determine a total loss based on the cost of repairs exceeding the car’s value.

So, a car with significant damage but still able to run might be totaled if repairs are too expensive. These vehicles often end up at salvage auctions and can be repaired by handy mechanics or used for parts.

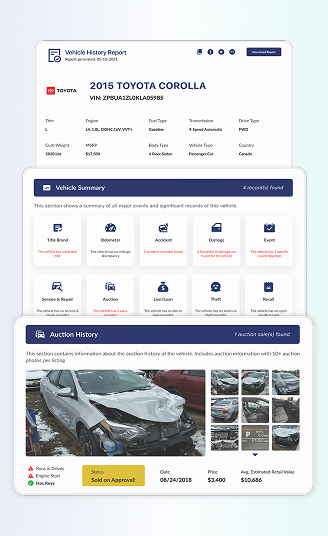

Used car buyers in non-European countries usually end up buying salvaged vehicles shipped from America and Europe. This has been ongoing for a while now. However, Premium VIN’s VIN check system has allowed many smart buyers and sellers to have a fore-knowledge of the history of any used vehicle before involving it in any transaction.

Run A VIN Check Now!

Does Total Loss Affect Credit Score?

Does a totaled car affect you? No, a totaled car typically doesn’t affect your credit score directly. There are a couple of reasons for this:

Credit Scores Focus on Borrowing Habits: Your credit score is based on your history of borrowing and repaying money. A totaled car isn’t a loan or line of credit, so it isn’t factored into your credit report.

Information Reported: Credit bureaus collect information from lenders and creditors. Since totaling a car doesn’t involve a lender or creditor, it wouldn’t be reported on your credit report.

However, there can be some indirect effects on your credit score related to a totaled car:

Changes in Loan Status: If the insurance payout doesn’t entirely pay off your car loan, you’ll still be responsible for the remaining balance. This could affect your credit utilization ratio (the amount of credit you’re using compared to your limit), which can impact your score.

Closing a Credit Line: If you pay off the entire loan with the insurance money, that credit line is closed. This can slightly decrease your score due to fewer accounts and a shorter average credit age.

Although totaling a car isn’t expected to hurt your credit score, managing the situation carefully is important to avoid any potential negative impact.

Utilizing Gap Auto Insurance

Gap insurance can be a lifesaver when your car is declared a total loss after an accident. This specialized insurance coverage fills the gap between what you owe on your vehicle and its actual cash value, ensuring you don’t end up financially burdened when your vehicle is a total loss.

In such situations, consulting with an experienced car accident attorney is crucial. They can help you understand your rights, navigate the complexities of insurance claims, and ensure you receive fair compensation for your totaled car.

Driving a totaled vehicle can be risky and may not be legal or safe, so having the right legal and insurance support after a total loss accident is essential.

Seeking Legal Guidance: Car Accident Attorney for Totaled Vehicle

Seeking legal guidance from a car accident attorney is essential when your car is totaled. Dealing with the aftermath of a totaled vehicle can be overwhelming, especially when navigating insurance claims and potential legal matters.

A skilled car accident attorney can provide valuable advice and representation to ensure you receive fair compensation for your totaled car through insurance settlements or legal actions.

Their expertise can help you understand your rights, negotiate with insurance companies, and pursue appropriate legal actions if necessary, easing the stress and uncertainty during this challenging time.

READ ALSO: How to Recover Control Skid

How to Avoid Buying Salvage Damaged Vehicle

A bad deal can lurk around every corner in the world of used cars. James, a fellow car enthusiast, recently shared a close call he had while searching for his next ride. Luckily, with a quick VIN check from Premium VIN, he dodged a major pitfall: buying a salvaged vehicle.

Like many car buyers, James was drawn to a used car advertised in excellent condition at a tempting price. However, something about the deal felt off.

That’s when he decided to take a proactive step and run a VIN check through Premium VIN. This simple step revealed a shocking truth: the car had a salvage title, meaning it had been declared a total loss by an insurance company due to severe damage.

This hidden detail could have turned James’ dream car into a financial nightmare. Extensive repairs or hidden safety issues could have emerged later, costing him significant money and jeopardizing his safety on the road.

James’ story serves as a valuable reminder for all car buyers:

Don’t be fooled by appearances: A seemingly perfect car at a great price can mask a troubled past.

The power of a VIN check: A quick and affordable VIN check like the one offered by Premium VIN can unveil a car’s history, including any accidents, repairs, or salvage titles.

Knowledge is power: Knowing a car’s story empowers you to make informed decisions and avoid costly mistakes.

Premium VIN: These companies offer comprehensive vehicle history reports for a fee.

By following James’ example and taking advantage of readily available resources, you can confidently navigate the used car market and ensure you get a safe and reliable vehicle. Get A VIN Check Now!